Project Description

How to remove infringements on Chinese Online Marketplaces?

A short guide for the brand owner

In this article, you will find information about China’s Online Retail Market, the distribution of Chinese Online Marketplaces, China’s Legal Framework followed by some practical insights on how you can report and remove counterfeit products and other types of IPR infringement on Chinese Online Marketplaces.

Is China the world’s largest producer of counterfeit?

In 2019, in a report released by the National Bureau of Statistics of China, Online Retail sales in China were said to have totaled to a staggering 1,33 trillion USD in 2018, a 23,3 % increase from the previous year. To put this number into perspective, it would mean that China’s online retail market is bigger than the US and European markets combined. In a report from Forrester released this year, it was estimated that China’s online retail market accounted for 83 % of all online retail sales in the Asia Pacific Region, and was to become twice the size of the US by 2022. Nevertheless, these numbers should be taken with a bit of scepticism, as figures in this field have been criticised before for not telling the whole story[1].

If China has the largest online retail market in the World, it shouldn’t come as a surprise that China probably has the largest counterfeit market as well. In 2015, the International Chamber of Commerce (ICC) estimated the global market for counterfeit goods to be worth 770-990 billion USD. In 2008 the World Customs Organisation estimated based on data from 121 countries, that 65 % of the World’s counterfeit shipments departed from China. In a more recent report from The Economist in 2016, they estimated that 66 % of all captured counterfeited goods came out of shipments from Chinese e-commerce platforms. In addition to the challenge of stopping sales of counterfeit goods online, brand owners also face a number of other types of abuse on Chinese marketplaces, such as unauthorised trademark use, impersonation and parallel import.

How do you go about monitoring the largest e-commerce market in the world? In this article, I hope to shed some light on this issue and provide some guidance.

Which Chinese marketplaces should I include in the monitoring?

We would recommend that you start with segmenting the market, learn who the big players are and how you could reveal the smaller niche markets relevant for your product. Let’s start with having a look at consumer to consumer (C2C), business to consumer (B2C) and business to business (B2B) distribution of marketplaces in China.

C2C Market

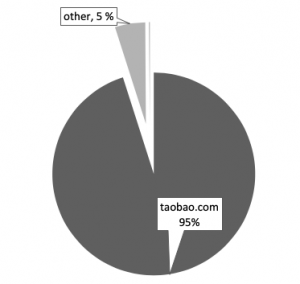

C2C distribution in China, numbers from iResearch 2014.

In numbers from iResearch 2014, Taobao.com, a site owned by the Alibaba Group, completely dominated the C2C market. We do not expect the numbers to have changed much since 2014. As of today, Taobao.com is listed as the 10th most visited site in Alexa ranking, and with their successful launch of Xianyu (Idel Fish), a popular second-hand store that was released in 2014 it is even likely that Taobao has increased its share in the C2C market.

B2C Market

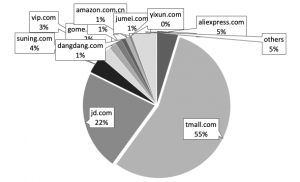

B2C distribution in China, numbers from iResearch 2015

Based on numbers published by the same research institute in 2015, the B2C market is also dominated by the Alibaba Group, who owns Tmall.com, which is world’s second-largest e-commerce site after Taobao.com, and the fourth most visited site in China according to the latest Alexa ranking. Please also note that Aliexpress.com is owned by Alibaba Group.

B2B Market

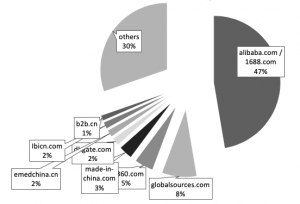

B2B distribution in China, numbers from China Market Watch 2015

Looking at the distribution of B2B marketplaces, based on numbers released by the China Market Watch in 2014, again, we can see that it is dominated by the Alibaba Group, which owns Alibaba.com and 1688.com. However, the big chunk of unknown marketplaces shown as “Others” is nevertheless important. This part is essential to understand as China has numerous niche marketplaces ranging from automotive to pharmaceuticals. From our experience, a lot of abuse happens on these marketplaces, which are also often characterised by inferior protection mechanisms.

Is it possible to cover all the marketplaces?

It is possible, however time-consuming. The good news are, if you would cover only Alibaba Group’s marketplaces, Alibaba.com, Aliexpress.com, 1688.com, Taobao.com and Tmall.com, in theory, you would monitor approx. 60 % of the Chinese online retail market. In a report from eMarketer released in 2018[2], it was estimated that Alibaba Group made up more than 58,2 % of Chinese online retail market in 2018, followed by Jd.com 16,3 %, Pinduoduo, 5,3 % and Sunning 1,9 %.

Include the last mentioned platforms into your coverage, and you would cover almost 75 % of the online retail market in China. It’s not 100 %, but it’s pretty decent taking into account that we are talking about the world’s largest online retail market.

However, we always advocate not forgetting the remaining 25 %. To expand your list, we recommend that you have a look at Chinese marketplaces ranked according to website visitors. Furthermore, conduct searches on Baidu.com (China’s largest search engine) for your brand to reveal marketplaces that are too small to be ranked by visitors or by market share such as yp900.com, bossgo.com and ecer.com.

How to detect counterfeit on Chinese Marketplaces?

If you have done your homework (read: segment the market and decide which marketplaces to cover), you should have a list of 10 – 100 Chinese marketplaces that you would want to have checked for abuse of your brand. There is no magic formula, and we suggest that you equip yourself with your inspection glasses and start visiting the sites from your list, one by one. This approach is suited for companies that don’t expect to find thousands of illicit sellers/month. For large companies within retail, for instance, an automated crawling solution would be the best solution. However, such a solution also comes with a high price tag not easy to justify for most brands.

Tips and tricks when searching on Chinese marketplaces.

To increase the relevance of your results, you should make use of the sorting functions of the sites. For example, on Alibaba.com you could sort by suppliers with the highest transactions volume. This search is advisable, as it potentially will provide companies that you likely should address first for the most significant impact.

Search function on Alibaba.com

Another example is the Image search and sorting by merchants on Taobao.com. The image search can be useful when you have a distinct logo or product image, and sorting by merchants on Taobao.com might help you identify sellers that are impersonating your brand in the shop name.

Search function on Taobao.com

The last marketplace that we will mention is Pinduoduo the fastest growing e-commerce app in China. Pinduoduo doesn’t have a web interface, and you can only access the site by downloading their app or visit their mini program on WeChat. It is important to notice that a lot of sales on Pinduoduo are so-called flash sales that expire within 24 hours. Hence, you need to visit this site more often to collect evidence of abuse.

Product listing on Pinduoduo

Find out if the infringer is active on more marketplaces.

When you have identified a seller or a company that is abusing your Intellectual Property Rights, we suggest that you conduct a name-based query on Google, Yandex and Baidu for the sellers/companies name in quotation marks “company name”. If you search with quotation marks, the search engine will return only exact matches of your search, potentially revealing more marketplaces, social media platforms or websites where the same seller/company is active.

Company search on Baidu.com

Formulate your China brand protection strategy.

If you have visited the marketplaces from your list and mapped out the abuse. You should end up with an overview, preferably sorted by priority as the example below.

An example visualization of results sorted by the number of cases identified

From this information, we can see that for this brand issues are predominantly on B2B platforms, with Alibaba.com having the most abuse. With this list, it becomes easy to formulate a brand protection strategy and knowing where to start.

Enforcing your right in China is not as “bad” as many thinks.

There is still a perception (all though changing) that brand owners cannot enforce their rights in China. China has in fact done a lot to improve its legal framework.

Firstly, China has signed most international agreements, which require its members to uphold a minimum standard of IPR protection, perhaps most notably:

- In 1980, World Intellectual Property Organization (WIPO)

- In 1985, the Paris Convention for the Protection of Industrial Property

- In 1989, the Madrid Agreement for the International Registration of Trademarks

- In 1992, the Berne Convention for the Protection of Literary and Artistic Works

- In 2001, China joined the World Trade Organization (WTO).

However, China is receiving criticisms over not upholding its commitments. At the same time, we see that China is continuing to improve its legal framework. A recent development worth mentioning is China’s New Amendment to their Unfair Competition law. The changes enhance the punishment for business operators engaging in unfair competition, which is a common issue identified on Chinese Marketplaces. You can read more about the amendment in an article with wrote with regards to fighting against cybersquatting in China HERE.

Secondly, and perhaps most notably, is the new E-commerce law that took effect on January 1st 2019. Previously, only individual merchants were liable for their illegal activities on Chinese marketplaces. Pursuant to the new law, operators (marketplaces) are now jointly liable if they are informed about an illegal activity happening on their platform. If the platform fails to take appropriate action such as delistings or blocking access, it can be subjected to a hefty fine. This law changes the game in favor of the trademark owner, as the law increases the incentive of the operator to investigate and comply with takedown requests. For example, we have seen that Pinduoduo introduced an intellectual property protection platform around the same time as China’s new E-commerce law took effect. Previously, brand owners had to explain the abuse over email correspondence.

How China’s Trademark Law differs from the one we are used to in the West.

China has a first-to-file doctrine. This implies that whoever files for the trademark first, will also gain the right to use it as long as the trademark is not well-known in China. It is, therefore, important to register your Intellectual Property in China. Especially, if you plan to enforce on platforms targeting a Chinese audience, such as Taobao.com, Tmall.com, and 1688.com for which you need Intellectual Property Registration from China. To enforce on platforms targeting an international audience, such as Alibaba.com and Aliexpress.com, an International Intellectual Property Registration is accepted.

Furthermore, China has adopted the NICE system, but requires application in subclasses (to an additional cost). So, please be aware that identical trademarks can co-exist in the same NICE class as long as the subclass is different. You can have the trademark “XYZ” in Nice Class 14 for sunglasses, while another company can register the same trademark “XYZ” in NICE Class 14 but for jewelry.

How to report counterfeit and abuse on Chinese marketplaces?

Since much of our focus has been on Alibaba Group and its marketplaces, and the fact they have approx. 60 % of the online retail market, we will walk you through how to report on Alibaba Group’s Intellectual Property Platform.

Step 1

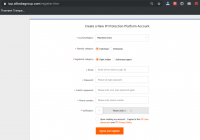

Register your an account on ipp.alibaba.com

To enforce on Alibaba Group’s platforms, you need to register an account on their Intellectual Property Protection Platform. To register you need to have a business registration certificate (it doesn’t have to be Chinese). Once you have registered your account, and you have uploaded your Intellectual Property Registrations, it’s time to file a complaint. If you are an agent, you should also register as one.

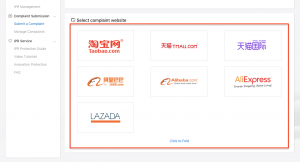

Select the platform that you want report abuse on

The IPP’s dashboard is available in English and Chinese and provides you with the possibility to file a complaint on any of their platforms.

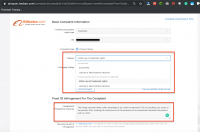

File your complaint and explain the illegality.

When you have selected the platform, you need to choose the IPR, provide the URLs, the reason and short description of the illicit activity. Please note that you can file bulk complaints up to 200 URLs.

Once you filed your complaint, Alibaba will typically handle it within 24 – 48 hours. If your claim is not accepted, where the content is unlawful (notwithstanding the IP claim) you can send a report directly to Alibaba at ipr@alibaba-inc.com.

We have experienced that Alibaba fails to handle certain complaints, such as when a trademark consists of two words “brand life”, and the trademark is mentioned in the title like (buy “brand” good looking “life” bag). Or if your trademark is “brand”, but the listing mentions your brand together with another word “brandword”. It is, however, understandable that Alibaba’s “abuse handling algorithm” is not yet tweaked to perfection, and why human intervention is sometimes needed. There are also a few options when filing your complaint that differs depending on the platform, for instance, on Aliexpress.com, and Alibaba.com you cannot report the storefront, which you can, on Tmall.com, Taobao.com and 1688.com.

Once you filed a successful complaint, and the merchant doesn’t provide a valid counter-notice, the merchant will receive a penalty point, and once the merchant reaches a certain score, their membership will be terminated. This is quite impactful since they can no longer register an account with the same ID or Business license. However, always take an educational approach when bad faith is not apparent, as many marketplaces, unlike Alibaba, doesn’t provide the merchant with the option to counter-argue, and most merchants do not have a complete understanding of the law.

What is the best way to reduce abuse on Chinese marketplaces?

When we start a China Marketplace Monitoring project for a client. We start with mapping out all the sellers selling the client’s brand. Based on this research, we can see where the products are being sold, and by whom. It also allows us to prioritise our effort where the issue exists and go after the biggest infringers first. If there is a company that has an alarming amount of infringing listings and likelihood to actually be producing counterfeit (or leading us to the source of the problem). We would inform the client that they could choose to go with a local partner in China for additional investigation (before we take action) such as the gathering of notarized evidence for the court (test purchases), and localization of the factory by on-the-ground visits. For the remaining cases, that are not likely to lead us to the source of the problem (unauthorized trademark use, unfair competition, parallel import) or of an educational nature (misuse of brand guidelines, unintentional infringements), we would address them right away, or if our client think there is no need to do further research. This way we can offer a complete circle of protection, online to offline.

At Thomsen Trampedach we have also developed a web-based case management and enforcement system that has hundreds of pre-configured enforcement workflows that we know work.

When you add a case in Pliano® such as from everychina.com, the system will suggest a proven take down workflow. The first step in this case would be to report the content directly through the platforms abuse form, and if not successful, send a pre-drafted takedown letter in Chinese to the administration.

Pliano® has over 70 premade enforcement mechanism for Chinese marketplaces and is continuously expanding.

For more information on how we can help you protect your IPR in China please visit this section: BRAND PROTECTION CHINA

[1] https://www.forbes.com/sites/douglasbulloch/2018/01/26/chinas-game-changing-retail-sales-should-be-greeted-with-skepticism/#312238d543f8

[2] https://www.marketing-interactive.com/alibaba-tops-e-commerce-market-share-while-facing-fresh-competition-in-china/

Interested in a China Screening?

We help dozens of brands with monitoring and removal of infringements on Chinese Marketplaces, Social Media Platforms and Websites. Reach out to us for a one-time landscape report where we screen for abuse of your brand. This screening will include, an overview of the abuse found in China, a brand protection strategy tailor-made for your specific needs balancing enforcement outcome and resources spent.